FDIC Banking Report: 305 Troubled Institutions up from 90 in 2008. $13.5 trillion Assets held with 2.1 Million Employees at 8,200 Institutions.

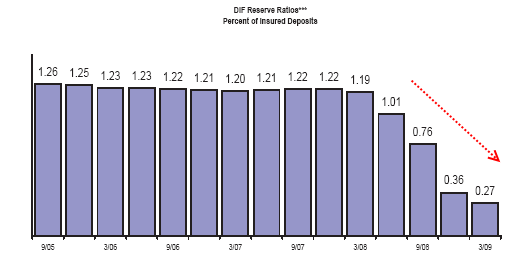

The FDIC is facing the highest amount of bank failures since the early 1990s. To calm Americans the government in 2008 upped the amount secured at FDIC institutions from $100,000 to $250,000 for each customer account. Yet losses have been so deep that in the fourth quarter of 2008 the Deposit Insurance Fund (DIF) quickly lost a large portion of its balance. The FDIC unfortunately did not adequately prepare for such a deep credit crisis:

What is drawing down the funds? It is the amount of banks going under and being taken over by the FDIC. The number is growing. Last year, the FDIC had 90 banks on its troubled list. Today, there are now 305. Keep in mind that last year gigantic failure IndyMac Bank which ate up nearly $10 billion of the fund wasn’t even on the troubled bank list. So take the 305 bank list for what it is worth from the FDIC. It is also the case that the FDIC will play a crucial role in the private-public investment program being dolled out by the U.S. Treasury. Recent reports estimate that the program will start in July and should be a taxpayer rip off to the ultimate extreme.

The PPIP will game the system and foot taxpayers with the bill of the most toxic assets in the world. Private investors will only need to come up with 5 percent while the U.S. Treasury will kick down 5 percent and the rest will largely be financed by non-recourse loans by the FDIC. It is incredible that we are going to give this institution which is already dealing with tremendous amounts of bank failures the duty of handling some of the most toxic mortgages known to the world.

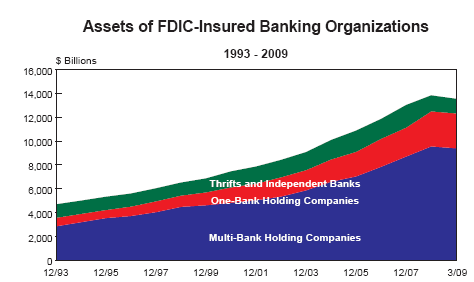

That is why that in the last year the actual amount of assets at these 8,200+ institutions actually decreased for the first time in 2 decades:

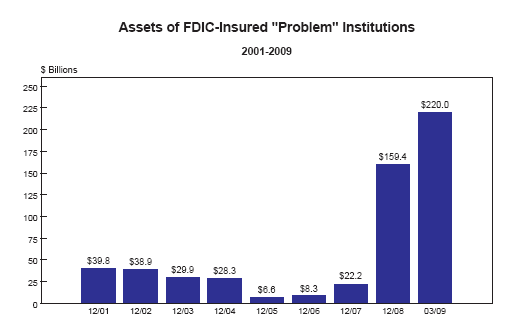

And even though 305 may seem like a small number out of 8,200 institutions you need to remember that many of the troubled banks are the biggest in the country and hold a large portion of all assets. During the Great Depression we had thousands of banks but not a group of “too big to fail” banks like we do now. In fact, taking the top 5 or 6 banks in the country makes up nearly 50 percent of all banking. Take a look how much is at risk now with the 305 on the list:

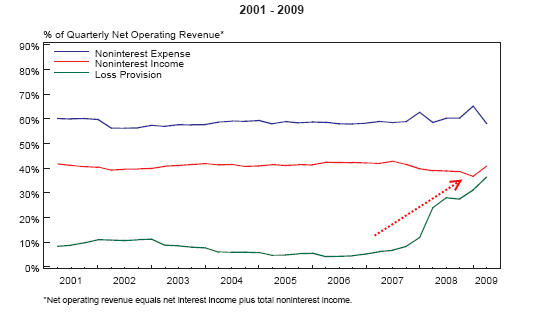

The troubled banks now have $220 billion in assets at risk. Remember the DIF above? The DIF as of March 2009 only had $13 billion, which of course is now much lower with the Q2 bank failures. With 25,000,000 unemployed or underemployed do you think late payments are going to increase? Of course. Mortgage defaults are already on the rise and nearly 1 out of 8 Americans with a mortgage are now either late or in foreclosure. The FDIC is insolvent and this is the place we are going to dump another $500 billion to $1 trillion in toxic mortgages. It also shouldn’t come as any surprise that loss provisions at FDIC institutions are skyrocketing still:

Now simply being on the troubled list does not mean a bank will fail. But given the current economic climate, it is highly likely that we will go well beyond the 305. In fact, some estimate that over a thousand banks will go under once this crisis is finished. This in large part is due to commercial real estate loans at smaller banks. Smaller banks did not have the direct line to Wall Street with the mortgage backed security bubble machine and had to rely on more local lending including CRE loans. That will be their undoing in the next few years.

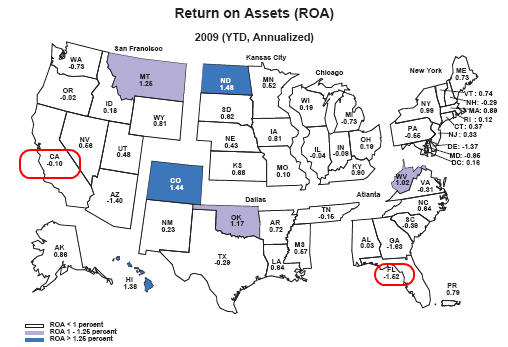

The return on bank assets is slim to none:

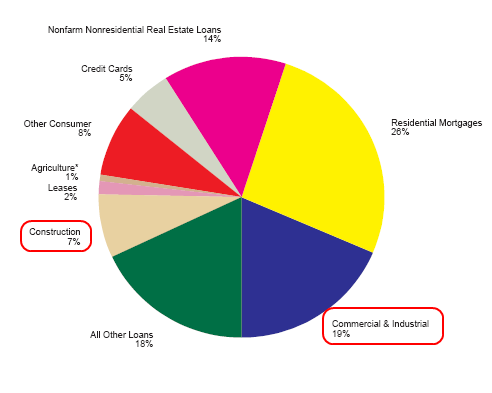

Big toxic mortgage states like California and Florida actually have negative returns which shouldn’t be a surprise given the unprecedented California housing bubble for example. And keep in mind that in this crisis, a large part of the attention has been given to residential mortgages but commercial loans are also a big part of banking assets:

The FDIC oversees banks with $13.5 trillion in assets. How much of these assets will turn toxic in the next few months will determine how quickly the FDIC DIF is gone. We are already approaching that limit. 305 troubled institutions is only the tipping point. There will be more. It is safe to assume that we will have 1,000+ failures once the CRE bubble bursts because there is no bailout mechanism (yet) in place for these. Talk about 2009 being a troubling year for the FDIC.

From http://www.mybudget360.com/fdic- ... -8200-institutions/ |