Summary

- The Eurozone has had numerous economic issues since 2010.

- Its stock market has reflected these problems.

- While Greece remains scary, both fundamental and technical considerations suggest that large cap Eurozone stocks may be more attractive than their U.S. counterparts, at least for a trade.

Background

In the summer of 2013, I began commenting bullishly on the prospects for European stock markets, first with Why My Money Went To Spain Today on July 26, followed by The Long Case To Buy Old Europe ETFs on August 6. After a bullish follow-up article in late September, I managed to top-tick the move in the SPDR EURO STOXX 50 ETF (NYSEARCA:FEZ) with "Un-Liking" Several European ETFs As The Internet Now Publicizes Them. FEZ reached its peak just around the date of that article, then corrected. Meanwhile, I focused numerous articles on domestically-oriented stocks such as Trinity Industries (NYSE:TRN) and Yahoo! (NASDAQ:YHOO).

Since selling out of Europe, the U.S. stock market has dramatically outperformed that of the Eurozone (see charts below). After this dramatic relative move, the question arose as to whether it's time to rebalance some funds committed to equities to the underperforming asset.

Therefore, I re-evaluated "old Europe" in view of subsequent market and economic developments, and liked what I saw enough to return to the topic with a fresh article, and have personally invested accordingly.

Introduction

When comparing developed markets with developed markets, a rule of thumb is to tend to favor the equities of the one with lower valuations. This is further true if investors in the home country have almost no interest in trading the cheaper market.

That situation describes the Eurozone stock market versus the U.S. right now.

In the U.S., investors have the opportunity to invest in a liquid index of large-cap/mega-cap stocks, FEZ. Its stocks account for about 60% of the free-float market capitalization of the EURO STOXX Total Market Index.

The FEZ ETF has about $4.5 billion in total assets. This is puny compared to the first U.S. ETF created, the SPDR S&P 500 Trust ETF (NYSEARCA:SPY); the SPY has about $195 billion in assets.

This difference is replicated in the dollars involved in trading in the U.S. markets. The average volume of the SPY is reported to be about 125 million shares daily. Multiply that by $210 to get the dollars changing hands daily. In contrast, FEZ only has 2.8 million shares trading daily, at a share price that has been running around $39.

The extent of this disparity can be seen by looking at a more minor ETF, theiShares MSCI Emerging Markets ETF (NYSEARCA:EEM), an iShares fund covering the emerging markets. Also at a price around $40, its average daily volume is around 52 million, far above the economically more powerful FEZ companies.

Relative valuations

Valuations of FEZ are favorable versus SPY. Here are the comparisons, courtesy of Yahoo! Finance. First, FEZ:

| Equity Holdings |

|---|

| Ratio | FEZ |

|---|---|

| Average Price/Earnings | 16.12 |

| Average Price/Book | 1.56 |

| Average Price/Sales | 1.01 |

| Average Price/Cashflow | 6.43 |

Next, SPY:

| Equity Holdings |

|---|

| Ratio | SPY |

|---|---|

| Average Price/Earnings | 18.51 |

| Average Price/Book | 2.63 |

| Average Price/Sales | 1.73 |

| Average Price/Cashflow | 9.22 |

Across the board, FEZ is less expensive - though not cheap.

Technical considerations

Before delving into the fundamentals, the technicals are important.

First, the chart of FEZ, then the chart of SPY.

As I see it, FEZ has the more promising chart. SPY has had a relative moonshot and may be looking a bit tired. FEZ is bursting upward in USD terms, and looks much better from the recently devalued euro standpoint.

Per the SPDR's website, FEZ has had an annual total return over the past 10 years of 3.35% versus 7.89% for the SPY. I think this relative return is more likely than not to tend to converge.

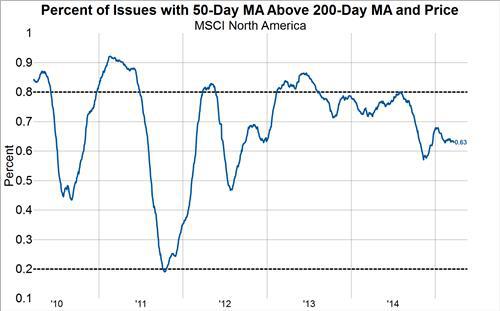

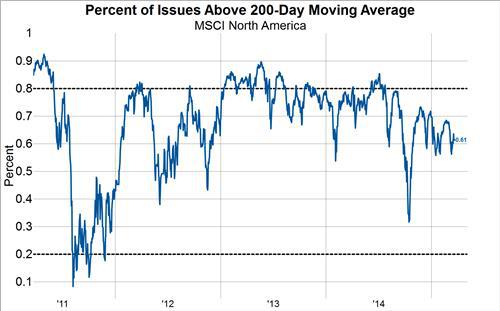

In that context, the various momentum and other charts presented Tuesday by the GaveKal blog support this view, as I see it. Here are two of the three charts for the MSCI North America index:

The above charts have some downside trending to them that I'm not in love with.

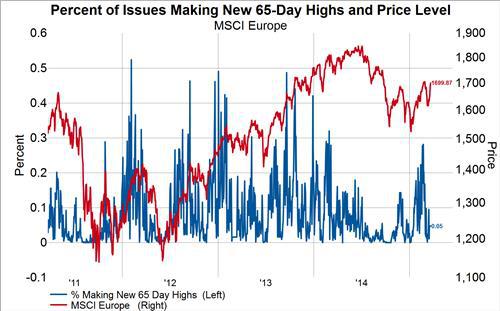

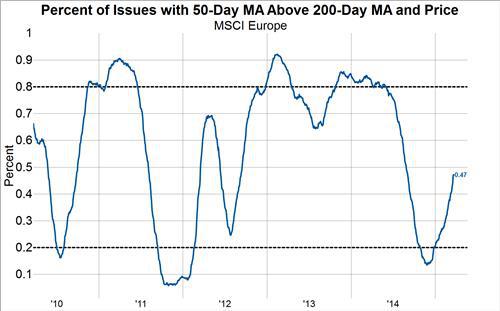

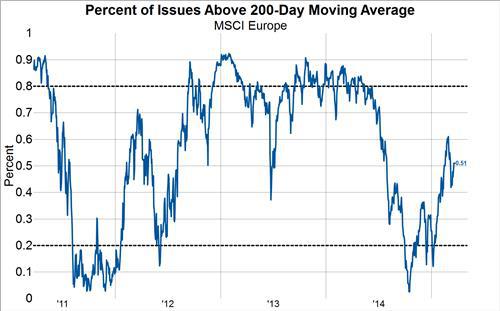

In contrast, while not in an established bull market at this point, all three charts shown below for the MSCI Europe index look promising. Is a turnaround underway?

The blog explains these charts a little more clearly than their titles do, and also presents the same three charts for the MSCI Pacific index.

Since all of the above looked good for a partial transition from U.S. equities toward FEZ, a little more digging was in order.

Comparative fundamental overview

Other fundamentals beyond the summary data given earlier support this.

The last 12-month dividend yield for FEZ is 3.4% versus 1.9% for SPY.

The largest and third largest holdings of FEZ, accounting for about 10% of its total value, are of pharma companies, Bayer (OTCPK:BAYRY) and Sanofi (NYSE:SNY). Interestingly, both have relationships with U.S. biotech star Regeneron (NASDAQ:REGN), of which Sanofi's is proportionally much larger than is Bayer's. The first and third largest holdings of SPY are Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT). While I'm quite bullish on AAPL, I'm not at all bullish on MSFT. In contrast, I'm reasonably bullish on both BAYRY and SNY.

The second largest stock in both FEZ and SPY is an oil major, Total (NYSE:TOT), versus Exxon Mobil (NYSE:XOM). I'm not sure how much there is to choose between these two stocks now. My guess - just a guess - is that it is the beginning of the end for the Oil Age and that both stocks are uninteresting in the longer perspective.

One theoretical advantage of SPY is that it is tracking an index of 500 stocks, whereas FEZ is tracking 50 stocks. However, 50 stocks of multinationals gives more than adequate metrics, so this advantage of SPY is more theoretical than real.

The nominal home country of the stocks in FEZ are each about 1/3 Germany and 1/3 France; however, all are multinationals and generally do business throughout the Eurozone, with the U.K., and throughout the world. So it's unclear how important that point is. For those who care, though, Germany is of course a powerhouse and France could be again. Whereas in comparison to the countries in the SPY, the U.S. is a known powerhouse but that knowledge is reflected in the valuations of U.S.-based financial assets. It's not always easy achieving alpha by owning well-recognized, high-quality assets. Sometimes you have to take a chance on #2 coming from behind from a stock market perspective.

What about the euro?

As Markit's PMIs out Tuesday show, the Eurozone is rebounding; its composite PMI neared a 4-year high. It may be that the euro has seen or is near its low, given that its massive QE program has been both well-advertised and has contributed to the large devaluation of the euro against all major currencies in the past months. On the other hand, any stimulation of economic activity induced by QE would tend to strengthen the euro.

The Eurozone was running a positive balance of trade before the euro crashed from above $1.30 to its current $1.10 level (and below). This strongly militates against a further crash of the currency.

Is the Greek situation an existential threat for the euro? Would a disorderly Greek bankruptcy seriously harm the value of FEZ?

These are important and unknowable issues. Since FEZ is an ETF that tracks a very large index of companies doing business throughout the world, a shock centered in the Eurozone would harm it, but over the long haul, these things work themselves out.

The demise of the euro, should it occur, would also work itself out. This would affect all multinationals; if it happens, the transition back to national currencies or one or more blocs of smaller currency unions (which might keep the euro name for continuity) presumably would be reasonably orderly, potential Greek exit notwithstanding (which may be disorderly).

Risks and other considerations

U.S. investors in FEZ receive a haircut on the dividends paid out by the companies. The sponsor, the SPDR group, absorbs the withholding taxes that apply to U.S. investors in the different countries in which the companies comprising the FEZ are domiciled. Thus, there is a continuous loss of income versus owning the individual stocks in the many countries that allow some form of forgiveness of the withholding tax. A SPDR rep confirmed to me by phone on Tuesday that this unfortunately does not apply to FEZ, only to ownership of the individual stocks.

This also means that my understanding is that FEZ can be owned equally well within an IRA, where the withholding tax cannot be recouped, as in a taxable account.

Over time, this difference in dividends justifies a lower valuation for FEZ versus SPY for U.S. investors.

(Even though it is from 2011, more details about withholding details for foreign stock holdings is found in a Seeking Alpha article, Withholding Tax Rates By Country For Foreign Stock Dividends.)

On shorter time frames, though, all this is known, and U.S. investors are, as shown, irrelevant to the actual trading of FEZ and thus do not materially influence its price.

Beyond those details, readers should understand that I believe that all developed stock and bond markets are richly-valued. FEZ is cheap, it's chancy, etc. At current valuations, permanent, or at least long term, impairment of nominal capital could result from a new commitment to FEZ.

Summary

The negative sentiment on the euro may be overdone. The Eurozone's economy has not been doing badly lately compared to its recent performance, yet its stock market, as measured by the FEZ, in USD terms, has been a dog until very recently. Despite having been doggy, it has rebounded and it's tracing out an uptrend, in USD terms, that is supported by improving fundamentals.

Thus FEZ may at the least have a minimal but sensible investment case. However, I think the case versus SPY is stronger than that.

Expectations for the Eurozone's QE are low, which can be a good set-up for upside surprises. There is reward as well as risk from the continuing jitters re Greece.

On the other side of the Atlantic, the Federal Reserve's balance sheet has begun to marginally shrink.

There are important caveats to the bullish thesis on FEZ laid out here.

Banking on a reversion to the mean of the performance of FEZ as measured in USD to that of SPY, I added to a small position in FEZ Tuesday morning around the current price of $39.56.

Additional disclosure: Not investment advice. I am not an investment adviser. Nothing in this article constitutes tax advice; all comments made are believed to be accurate but may not be, or may not be applicable to any individual or fund investor's specific situation.

狗仔卡

狗仔卡 发表于 2015-3-26 07:14 AM

发表于 2015-3-26 07:14 AM

提升卡

提升卡 置顶卡

置顶卡 沉默卡

沉默卡 喧嚣卡

喧嚣卡 变色卡

变色卡