|

|

发表于 2020-10-9 11:13 PM

|

显示全部楼层

发表于 2020-10-9 11:13 PM

|

显示全部楼层

Refi Ahead of Condo Trouble?

By The Spy on

October 7, 2020

—The Mortgage Report: Oct. 7—

- Toronto condo listings have exploded 215% to a record high, reportsBloomberg. And they’re projected to be even higher in October, according to HouseSigma.

- Driving that surprising number:

- skittish investors (many with negative cash flow given surging rental listings and a 14% y/y drop in rents)

- “elevator phobia”

- people coming off mortgage deferrals

- relatively higher unemployment among condo dwellers

- office-liberated workers ditching the city for bigger, greener spaces, and

- the damaging self-reinforcing psychology of surging listings.

- It’s like that tropical storm in the Atlantic. You see it building and wonder if it can become a Cat-5.

Well, the winds are picking up and lenders are risk averse. If urban

condos depreciate more from here, more appraisals will undershoot

expectations and lenders will underwrite

mortgages secured against such properties noticeably more

conservatively. “…We do see things softening enough to drive condo

prices down,” RBC economist Robert Hogue told the Globe recently. - In

other words, if you own a big-city condo downtown, plan to keep it for a

while, are contemplating refinancing and need to borrow the full 80% of

your property value, contemplate quicker. If condo values dive (which

is not a prediction, but a real possibility) your loan amount could dive

with them. - So far, major brokers we talk to like Monster

Mortgage’s Vince Gaetano, Butler Mortgage’s Ron Butler and Sigma

Mortgage’s Shawn Stillman, say they’re not seeing serious appraisal

trouble or credit tightening on condos yet. Although:- Gaetano notes, “Appraisers are a little hesitant on refinances, but are less worried on purchase values.”

- Stillman

says some lenders are now scrutinizing condo status certificates more

upfront. They’re trying to spot anything that could adversely impact

resale value if a client defaults, like low reserve funds or

potential/pending lawsuits.

[img=sold and active condo listings in Toronto]https://www.ratespy.com/wp-content/uploads/2020/10/image-1-700x400.png[/img]The explosion in Toronto condo listings. Courtesy of HouseSigma.

Lots of Buyers Holding Off

- According to the 2020 Scotiabank Housing Poll:

- 32% of younger Canadians are waiting for prices to drop in the next six to 12 months before making a home purchase.

- 38% of Canadians believe now is a good time to buy a new home.

- 42% of homeowners looking to buy a new property say they’ll use equity from their existing primary home to do it.

More Warning Bells From Siddall

- The head of Canada’s housing agency will tell anyone that

listens about how risky Canadian real estate is. CMHC President and CEO

Evan Siddall talked to Mortgage Professionals Canada on Tuesday. Among

his statements:- Canadian home prices “bear no relationship to underlying economics.”

- “Trees don’t grow to the sky.”

- “Trust me, this game of musical chairs ends and the last people standing are these folks loaded with debt.”

- “If you think this all ends well, go to Detroit.”

- “The

thing that causes people to lose their homes is unemployment…So, the

fact that they can currently service their debt is irrelevant to whether

they’re going to have a foreclosure or not…The real issue is their vulnerability to unemployment.”

- Mortgage brokers provide “more value” than Realtors and are “essential to our real estate markets.”

- A

quick comment on this one: Siddall is no friend of the real estate

complex and vice versa. Hopefully his successor is less inclined to

throw the entire profession under the bus, as that’s a disservice to

Realtors who don’t over-hype real estate, are honest with their clients and work in their best interests. - As

just one little example of a fiduciary Realtor, earlier this year, this

author bought a property. Our Realtor negotiated an additional $20,000

off the price after the deal was signed, something we could not

have done without her. That saved the equivalent of five years of

mortgage interest. That’s more than any mortgage broker could have saved

us. The point: the right Realtor can add tremendous value. - On

the other hand, casual or inexperienced real estate agents in no way

justify 4-6% commissions—whether those fees are paid out of pocket or

baked into a home’s price. And yes, one could say something similar

about greenhorn/part-time mortgage brokers.

- Separately,

Siddall noted that CMHC will be advising the Finance Minister and

Minister of Families, Children and Social Development on the proposed revision to the First Time Home Buyer Incentive. This proposal boosts buying power for young buyers, running counter to what Siddall’s been preaching.

RBC Capital Markets on Mortgage Deferrals

- In a report Tuesday, RBC analyst Darko Mihelic shared new insights on Canada’s mortgage deferral quandary:

- “Currently

11% of mortgage borrowers in Canada are not making mortgage payments,

about 17 times higher than the worst mortgage delinquency rate in the

last 30 years…” - “We believe 10% to 15% of mortgage borrowers on deferral are unemployed,” he wrote.

- “We

believe 10% to 20% of mortgages under deferral are at a higher risk of

defaulting” implying a mortgage delinquency rate up to 2.3% when

deferrals end. - RBC does not, however, expect an arrears rate near 2.3%, in part because of:

A) government income support programs, and

B) “cash stockpiling” — i.e., deferring borrowers have “likely” saved

up 4+ months of mortgage payments on average, RBC estimates. - “We

believe mortgage impairments have been pushed out to Q3/21 maybe even

Q4/21,” RBC concludes, citing enhanced Employment Insurance (EI) and the

new Canada Recovery Benefit as two reasons not to panic.

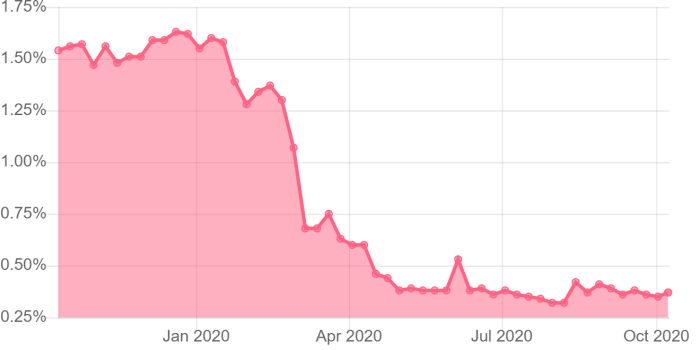

Central Banks Dominate Rate Markets

Canada’s 5-year bond yield Canada’s 5-year bond yield

- The 5-year government bond yield,

which guides fixed mortgage rates, remains in a remarkably tight

trading range. We’ve never seen anything like it in 13 years of covering

the bond market. - Much of the flatness is thanks to the Bank of Canada, which has been buying 5-year bonds without taking a breath. The Bank is doing this largely to keep mortgage rates down.

- With all it’s buying, a CIBC report we read Wednesday suggests the BoC will own virtually half the 5-year government bond market by spring.

- Such

constrained movement (i.e., extremely low volatility) can only mean one

thing. Once there’s a significant surprise in the inflation outlook,

fiscal outlook, Canada’s credit outlook or the Bank of Canada’s bond

buying intentions, rates will vigorously uncoil. We just don’t know if

they’ll uncoil to the upside…or downside.

[img=central bank assets growth around the world]https://pbs.twimg.com/media/EjrnnU3UcAUL5Nc?format=jpg&name=900x900[/img]

Oil Not Coming Back: BP

- If you’re looking for more evidence to support a long-term

low rates thesis, BP’s opinion is worth considering. It’s the first oil

supermajor to pronounce that global petroleum demand growth has peaked. - If that proved true, it would be inarguably bearish for domestic mortgage rates (other things equal) given how vital energy is to Canadian GDP.

|

评分

-

1

查看全部评分

-

|