|

|

~200 Managers overseeing $500B AUM responded to this month’s BofA survey.

OUTLOOK:

79% expect stronger economy. Highest since 2009.

Net 57% of polled respondants want companies to improve balance sheets instead of expanding capex.

Just 17% forecast a quick, V-shaped economic recovery

37% expect a W-shaped recovery that will come in stages.

31% expect U-shaped recovery that will take time.

Respondents expect a vaccine announcement in Q1 2021.

57% expect higher profits in the next year. Up 21 percentage point and highest level since March 2017.

A net 43% of investors said climate change is the ESG theme that will “outperform most” over the next year.

Inflation expectations rose 15 percentage points (net 52%) of respondents expecting a higher global CPI.

Global stocks have rebounded just over 50%, adding ~$24 trillion in value in five months.

“Peak Policy” theme expected to cause September volatility – but needs disorderly rise in rates to manifest.

Managers expect 10-year Treasury yield lower than 0.5% by year-end.

SENTIMENT:

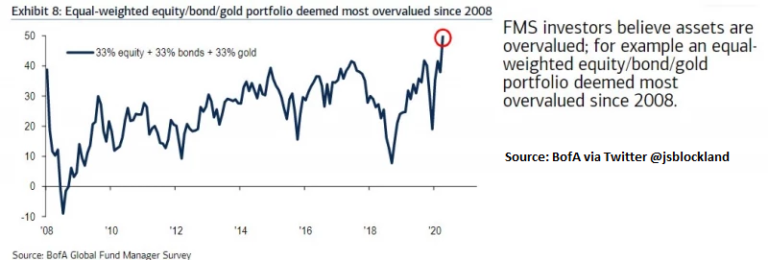

Respondents see an equal-weighted portfolio of equities, bonds and gold as the most overvalued since 2008.

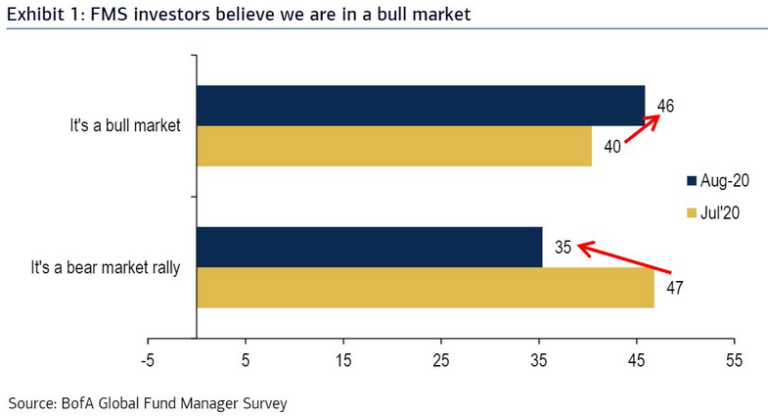

46% now see equities as in a bull market compared to 40% in July.

35% say it’s a “bear market rally” versus 47% in July.

BofA Bull & Bear Indicator up to 3.7 (far from excessively bullish).

31% say gold is overvalued – highest percentage since 2011.

More than a third of investors believe the time to be bearish over.

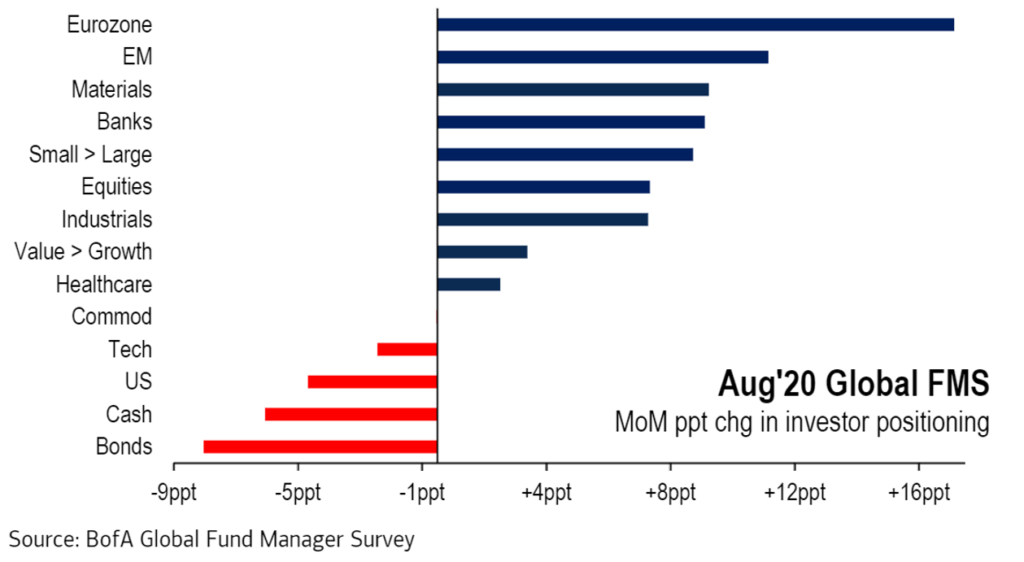

POSITIONING:

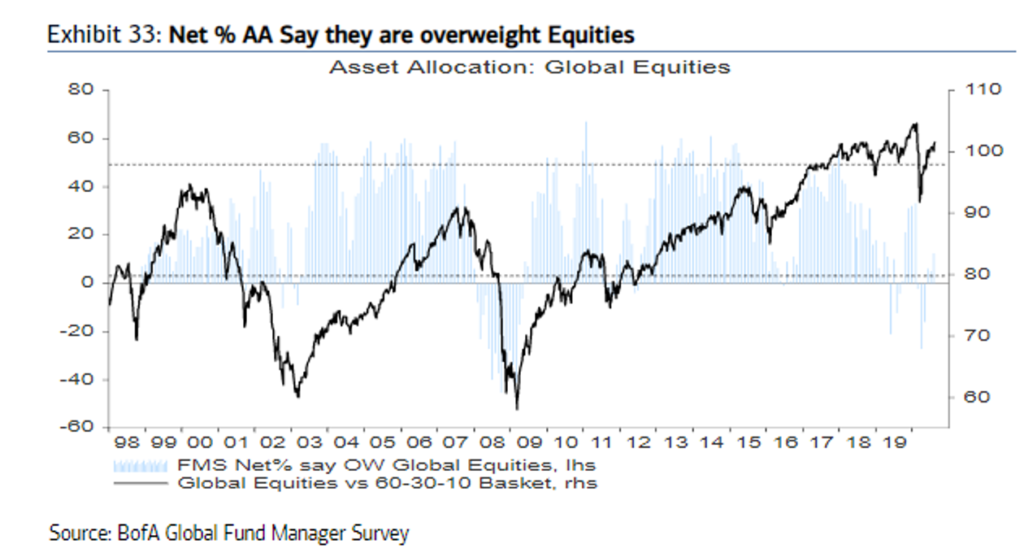

Net 12% were overweight Global equities. Up seven percentage points since July.

Not “dangerously bullish” according to BofA.

U.K. stocks remain the top regional underweight.

Cash allocation fell 6% to net 26% overweight versus last month.

Rotation toward euro-area and emerging-market equities.

Eurozone is now the most popular equity region among the poll’s investors: Allocation increased 17 percentage points to a 33% overweight. This is the highest since Spring 2018.

Emerging Market equities rose 11 percentage points to (net 26% overweight).

Exposure to U.S. stocks declined 5 percentage points (net 16% overweight).

Allocation to US, UK and Japanese equities all fell by 5 percentage points or more.

Cash levels down to 4.6% but in neutral range (<4% = greed, >5% = fear)

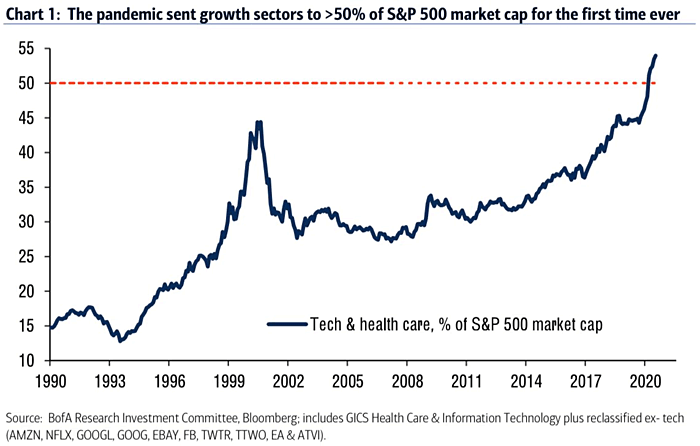

Asset allocation remains “stubbornly” skewed towards Healthcare, US, Tech, Cash and Short Energy.

Investors adding Eurozone and emerging-markets stocks as the dollar weakens.

Banks, Materials and Small Caps were more in demand as bonds, cash, U.S. and Tech showed less demand than previous surveys.

Commodities allocation remained at its highest level since July 2011 (net 12% overweight).

Real Estate reversed its net underweight positioning, increasing to (net 1% overweight) for the first time in four months.

Passive investing is down a bit. 22% of investor AUM was allocated to ETFs, dropding one percentage point from last month.

Fewer investors intend to increase Passive exposure, down seven percentage points to 10%. This is the lowest level since July 2019.

Managers expect to rotate their investments into Europe, Emerging Market Equities, Banks, Small-Cap and Value Stocks.

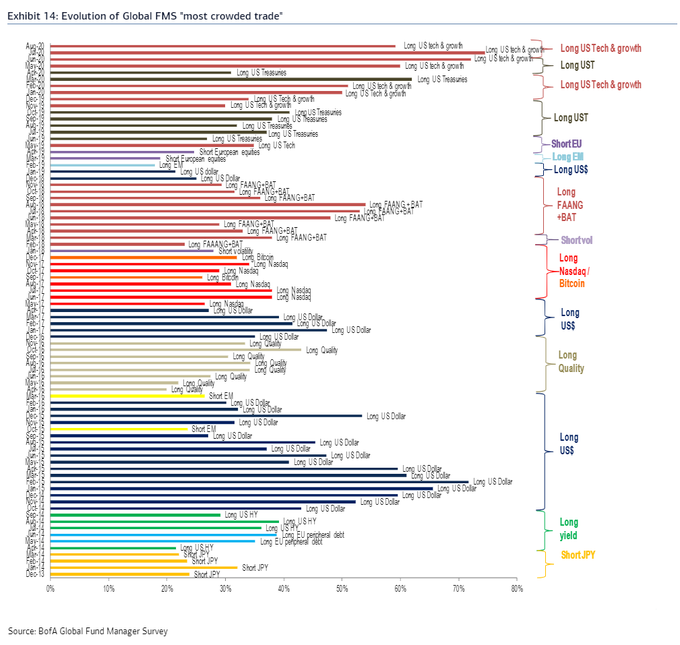

MOST CROWDED TRADE:

Long US tech (59%)

Long gold (23%)

Long corporate bonds (8%)

BIGGEST TAIL RISKS:

1. Second wave of Covid-19. (35%)

2. U.S.-China trade war. (19%)

3. U.S. election/Blue Wave. (14%)

4. “Credit Event.” (13%)

CONTRARIAN TRADES:

Contrarian risk on/vaccine and higher rates trade (BofA): Long Small-Caps and Short tech.

Net 70% of respondents thought the Senate flipping to Democratic control was a “risk off” signal that would best be played by shorting health care stocks.

|

|