Summary

- This gatekeeper tech firm has the highest dividend yields in its peer group, with 2 very well-covered 7% yielding stocks, and a well-covered 5%-plus yielding stock.

- This firm also has the lowest P/E, and the highest Return On Equity and Operating Margin in its peer group.

- The tech sector has outperformed the market over the past 3 months and year-to-date.

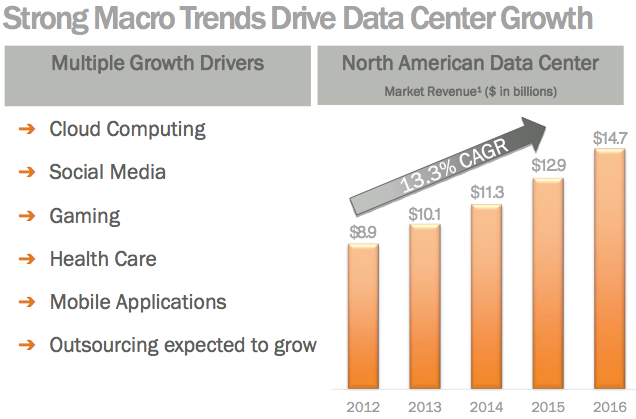

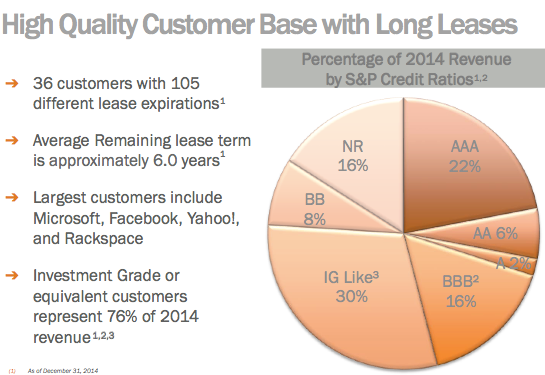

Looking for a way to profit from all that stuff we send to the cloud -- movies, songs, shows, games etc? As it turns out, there are some very profitable cloud gatekeeper companies, 2 of which offer attractive dividend yields. These companies run huge data centers, and collect rents from their customers, via long term triple net leases. They're riding a very powerful macro trend:

(Source: DFT website)

We've tracked the multiple stocks issued by DuPont Fabros Technology, (NYSE:DFT), and one of its competitors, Digital Realty Trust, (NYSE:DLR), in our High Dividend Stocks By Sectors Tables, for quite awhile now, (in the Tech section). They both offer attractive 5%-plus yields on their common stocks, and even higher yields on their preferred stocks.

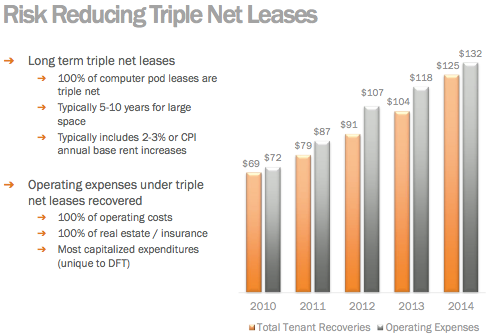

Focus Stock Profile: DuPont Fabros Technology, Inc. is a real estate investment trust (REIT) that went public in 2007. DFT is a leading owner, developer, operator and manager of wholesale data centers. The company's data centers are highly specialized, secure, network-neutral facilities used primarily by national and international Internet and enterprise companies to house, power and cool the computer servers that support many of their most critical business processes.

Well known industry leaders, including Microsoft (NASDAQ:MSFT), Yahoo (NASDAQ:YHOO) and Facebook (NASDAQ:FB), entrust DFT to provide continuous power and cooling to their computer servers and network equipment that support their critical business processes.

(Source: DFT website)

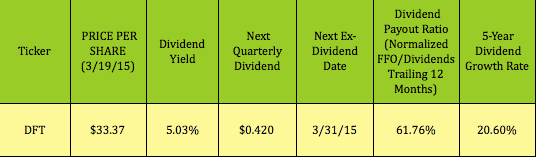

Dividends: As we detailed in a previous article, DFT raised its common dividend by over 45% in 2014. Looking back further, DFT has achieved a 20%-plus 5-year dividend growth rate. DFT's common shares go ex-dividend on 3/31/15:

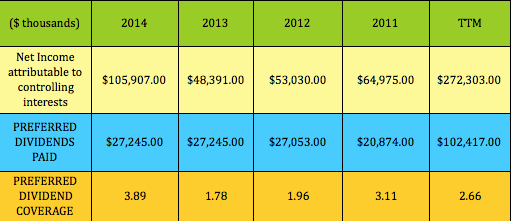

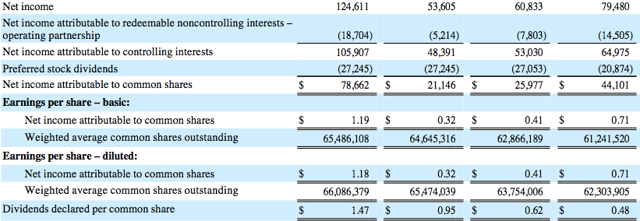

Preferred Dividends: DFT's preferred dividends are very well-covered, since, like most companies, it deducts its preferred dividend payments from net income before it calculates earnings/share, AND, unlike some companies, it has ample net income for coverage.

Here are actual figures for 2014, 2013, 2012, and 2011,(left to right), from DFT's 12/31/14 10K:

(Source: DFT website)

DFT's preferred coverage has averaged 2.66x over the past 4 years:

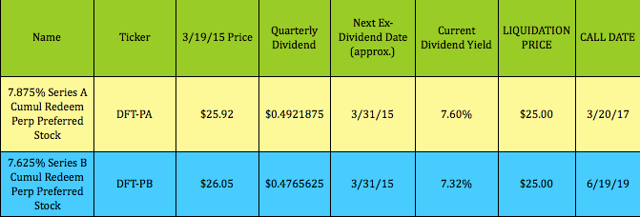

DFT's 2 preferred stocks also go ex-dividend on 3/31/15. Both of these preferred shares yield over 7%, higher than DLR's preferreds, which are in the 6%-plus range:

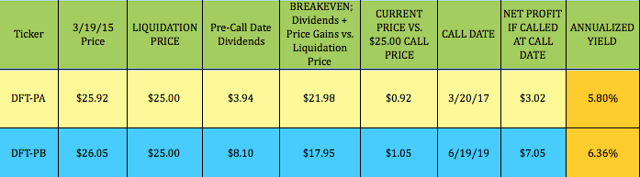

Long-Term Yields: Although both preferreds are above their $25 liquidation price, they're still far enough away from their call dates, to offer attractive long-term yields.

This table details your net profit, if you bought these shares now, held them until their call dates, and if DFT were to liquidate them on their call dates. The DFT-PB shares have a higher long-term yield, even though their current yield is lower than DFT-PA's shares.

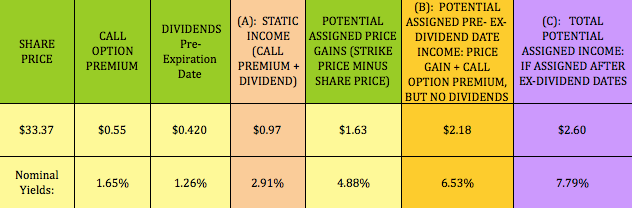

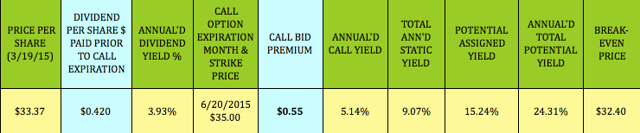

Options: DFT also has options available. We've added this June 2015 call-selling trade to our Covered Calls Table, which tracks over 30 covered call trades.

This table details the 3 main scenarios for this covered call trade. There is 1 dividend payout before the June expiration. Since the $35.00 strike price is $1.63 over DFT's $33.37 price/share, this trade offers you some potential price gain participation, in addition to the $.55 call option premium:

(click to enlarge)

We don't yet have any DFT put trades on our Cash Secured Puts Table, as its put options yields aren't currently that attractive, but we do track over 30 other put-selling trades there.

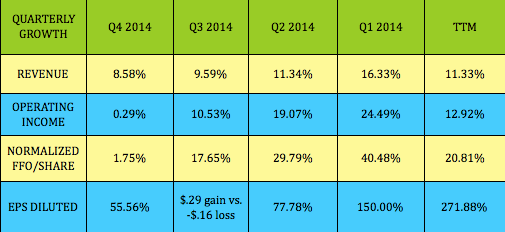

Earnings: DFT has achieved solid growth in all of these categories in its last 4 quarters. The trailing 12 month total percentages coincide with its figures for full year 2014 vs. 2013.

Here are the $ figures for the past 4 quarters:

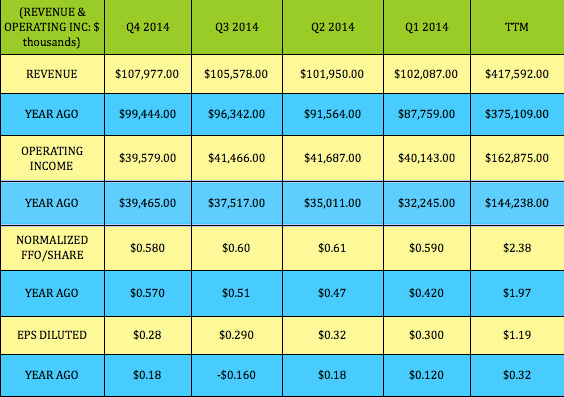

DFT's business model is based upon long-term triple net leases with strong tenants, and annual base rent increases:

(Source: DFT website)

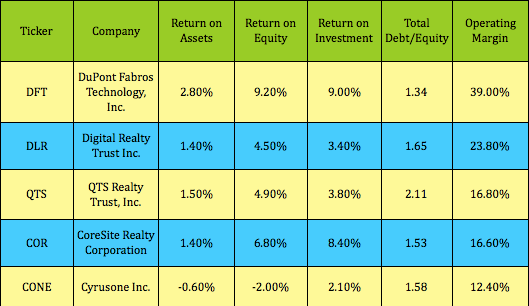

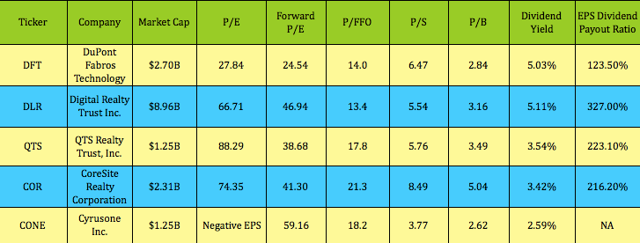

Valuations: Here are comparison figures for DFT and its main competitors -- DLR, QTS Realty, (NYSE:QTS), CoreSite Realty, (NYSE:COR), and Cyrusone, (NASDAQ:CONE), which isn't profitable yet, but is projected to turn a profit in 2015.

DFT looks cheapest on a P/E and forward P/E basis, and has the lowest EPS dividend payout ratio. DLR has a slightly higher common dividend yield, and is cheaper on a P/FFO basis.

Financials: DFT has the best Management Efficiency ratios of the group, the highest Operating Margin, and the lowest debt load.

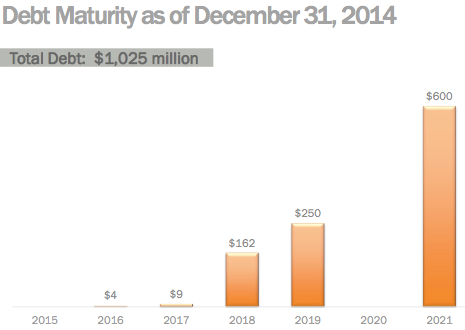

DFT's debt is long-term, and tiered well into the future, with maturities starting to ramp up in 2018:

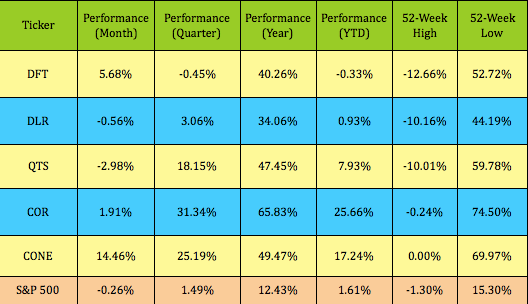

Performance: All of these stocks have strongly outperformed the S&P 500 over the past year. COR and CONE have received analyst upgrades in 2015, which probably accounts for their outperformance this year.

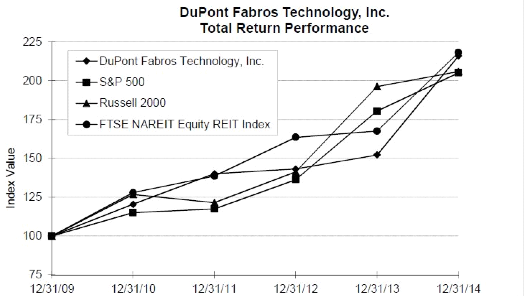

Looking back further, DFT has been a solid performer since 2009:

All tables furnished by DoubleDividendStocks.com, unless otherwise noted.

狗仔卡

狗仔卡 发表于 2015-3-22 04:17 PM

发表于 2015-3-22 04:17 PM

提升卡

提升卡 置顶卡

置顶卡 沉默卡

沉默卡 喧嚣卡

喧嚣卡 变色卡

变色卡

发表于 2015-3-23 04:22 AM

发表于 2015-3-23 04:22 AM