We did some sleuthing and data extraction and put M3 back together from various weekly Federal Reserve reports that are still available.

1. The formula we're using has five 9s correlation to the original data back to 1980.

2. There is only one missing element that is apparently no longer available (Eurodollars) and an adjustment has been applied to generate it. Its only about 3% of total M3 so should not have a material effect on the total.

Here is our article on M3b, which details our work and notes the sources for the data. Note that as of Nov. 10, 2006 the Eurodollar estimation formula has changed - see the article for details.

John Williams monthly reconstruction of M3 is here. Ours tends to be more volatile than his, partly because it's weekly and partly because of our differences in calculating the repo and Eurodollar component of M3.

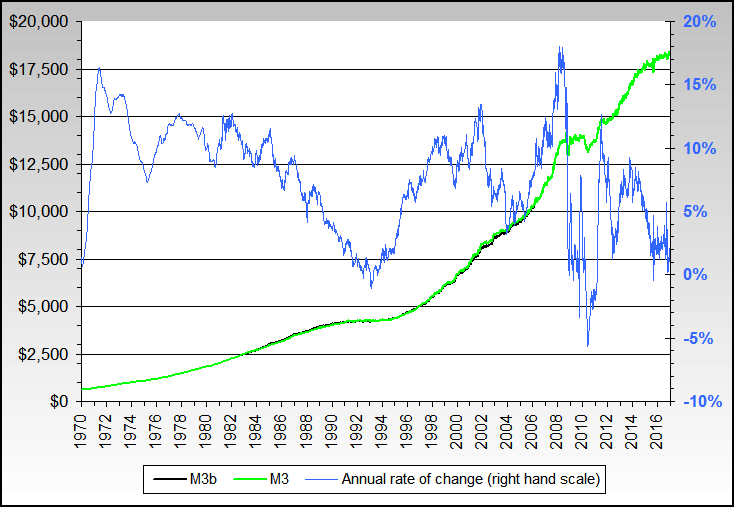

Finally and to put M3 into proper perspective with inflation (as measured by CPI without lies), the M3 and M2 strong inflation link is virtually unquestionable. The longer term inflation picture is clear, although M2 shows a pause and likely temporary disinflation as of 2008. Certain bloggers are incorrect and have continually avoided these facts and the linked chart.

M3, longer term chart

|